What if I told you that you can get instant loans on your cryptocurrency without selling it and can also get high-yield interest on your crypto and fiat deposits?

Nexo.io: Instant Crypto Credit Lines

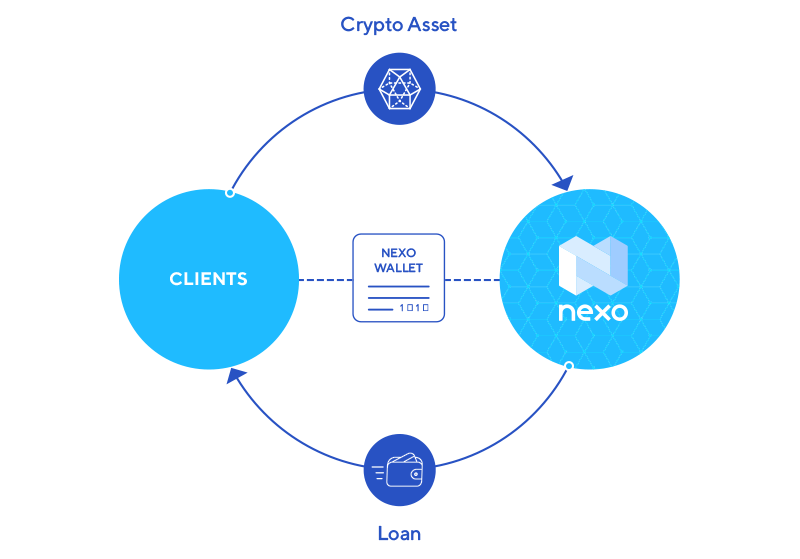

Introducing to you, the Nexo.io platform. The Blockchain-based crypto-assets-backed loan platform lets you borrow instantly in 45+ fiat currencies and earn daily interest on your idle assets. They even offer the Nexo Master card in which you can access the credit line worldwide and get instant cashback on all purchases paidn your local currencies. The best part is that there are no monthly or annual fees and even no FX fees as well.

How does it work?

Once you deposit your crypto assets to your Nexo account, a credit line becomes instantly available to you (No Credit Checks). Credit line value is determined by the Nexo Oracle algorithms, depending on the current and historical volatility and market liquidity of the particular assets.

Depending on the type of assets you deposit, the loan-to-value (LTV) ratio ranges from 20% to 50%. Example: If you stake $10,000 worth of BTC, you will be able to withdraw an instant loan of approximately $5,000.

Once you get the credit line, you can spend money using the Nexo master card or withdraw the funds to any account by choosing the withdrawal method, and currency, and entering bank account details.

Now, let’s see what are their loan terms.

Nexo loan terms

- Interest: The annual percentage interest rate (APR) starts at 5.9%, still much lower than the average credit card rate. Interest is charged only on what you use and for the days you borrow. No minimum loan repayments are required, as interest is debited automatically from your available credit limit.

- Maturity: up to 1 year (may be renewed on request without repayment). You can repay all or some of your loan early at any time and you could save interest.

There are several options to repay the loan, and all take one click to arrange: 1) using fiat currencies (USD, EUR, etc.), 2) using your NEXO Tokens to receive attractive discounts or 3) using а partial sale of his crypto assets at current market prices.

Features, Limitations, and terms.

- The Nexo Minimum Loan Limit: $500

- The Nexo Maximum Loan Limit: $2 million

- The Nexo Loan To Value Ratio (LTV): 20%-50%

- The term of the loan for Nexo is up to 1 year

- The interest rate for your Nexo loan: is 8% (with Nexo tokens) otherwise 16%.

- There is an inbuilt calendar that helps you to keep track of the loan taken on time.

Earn 8% on Your Crypto Assets

Earn 8% interest per year which is significantly higher than traditional bank deposits and alternative investments. Nexo offers you full flexibility by allowing you to add and withdraw funds at any time.

To start earning, all you need to do is, deposit your crypto asset to Nexo wallet.

How can you get an instant loan on Nexo?

- Firstly, create an account on Nexo.io and complete your KYC using your personal details and documents.

- Second, Deposit your Crypto assets to your Nexo account on the blockchain.

- Once, you deposit the assets successfully, an instant credit limit will be available and you can withdraw it instantly to any bank account in the world.

Why use the Nexo Platform? Is it trusted?

Nexo is a fantastic platform for instant crypto-backed loans wherein you can make the most out of your crypto assets without selling them. It helps the investors to grow and then market their share, which makes it an excellent choice altogether.

Nexo is backed by many reputed organizations like Credissimo and tech entrepreneurs like Techcrunch.com founder Michael Arrington.

Its token is an SEC-compliant dividend-paying asset-backed security token. The NEXO Dividend token pays out 30 percent of the company’s profits to token holders each month.

Nexo uses Military-Grade Security with 256-bit encryption and cutting-edge technological advances, as well as 24/7/365 Fraud Monitoring. The Custodial assets are also covered by a $100M insurance policy provided by BitGo and Lloyd’s of London. BitGo incorporates the Cryptocurrency Security Standard Level 3 and is SOC 2 compliant.

So, that’s it about the Nexo platform. You can give it a try by depositing a small number of crypto assets like Bitcoin to the Nexo wallet.

Do let me know if you’ve any questions about Nexo in the comments.

This article about Nexo.io review is great. I’ve been trying to learn about Bitcoins for a year now but this article honestly made me feel like I actually know how it works for the first time. I am also going to share this information with my friends and family. So thank you so much.

Very nice idea thanks for sharing website. I really like it.

It will be very helpful for me.

This is a really amazing informative post.

Great article. I’ve been using Nexo since 2020, and I must say it’s a great product. It has survived the FTX collapse era, so it shows how reliable and safe it is.

Can you also have a look to Bingx crypto exchange ? Is this a reliable exchange?